Segment Switzerland

Market environment Switzerland

The issues of digitization and cost reduction in the healthcare sector remained topics of heated debate in 2017, in both political and societal circles. The consultation procedure on the ordinances of the revised Therapeutic Products Act (TPA) triggered numerous comments by various stakeholders. And when once again an average increase in health insurance premiums of 4 percent was announced in the autumn, emotions were running high everywhere. In this context the cost containment proposals from a group of experts commissioned by the Federal Council were also the subject of intense discussions. The political pressure to do something about the rising costs in the healthcare sector is increasing noticeably.

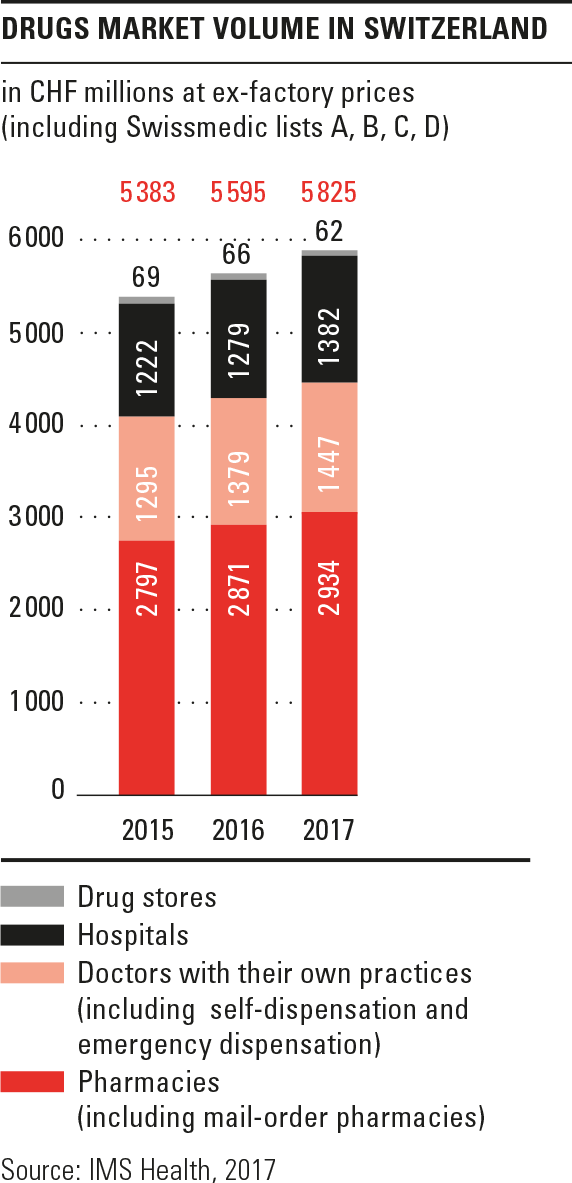

Rising drugs market — In 2017 the drugs market in Switzerland amounted to around CHF 5.8 billion at ex-factory prices. That is 4.2 percent more than in the previous year and at the same time it also means weaker growth than in previous years (2016: 4.7 percent, 2015: 5.1 percent) In contrast the number of packs sold fell by 1.3 percent to 184.9 million units. The growth in terms of value is attributable in particular to some new and expensive drugs against cancer and auto-immune diseases. For the first time in three years, another round of price reductions was announced in 2017 for drugs covered by mandatory health insurance. The decreed price reductions affecting around 350 drugs came into force on 1 January 2018 and 1 February 2018 respectively. Other price reductions will follow in the course of 2018. For that reason, they did not yet affect the market volume in 2017 (source: interpharma and vips ‘Association of Pharmaceutical Companies in Switzerland’).

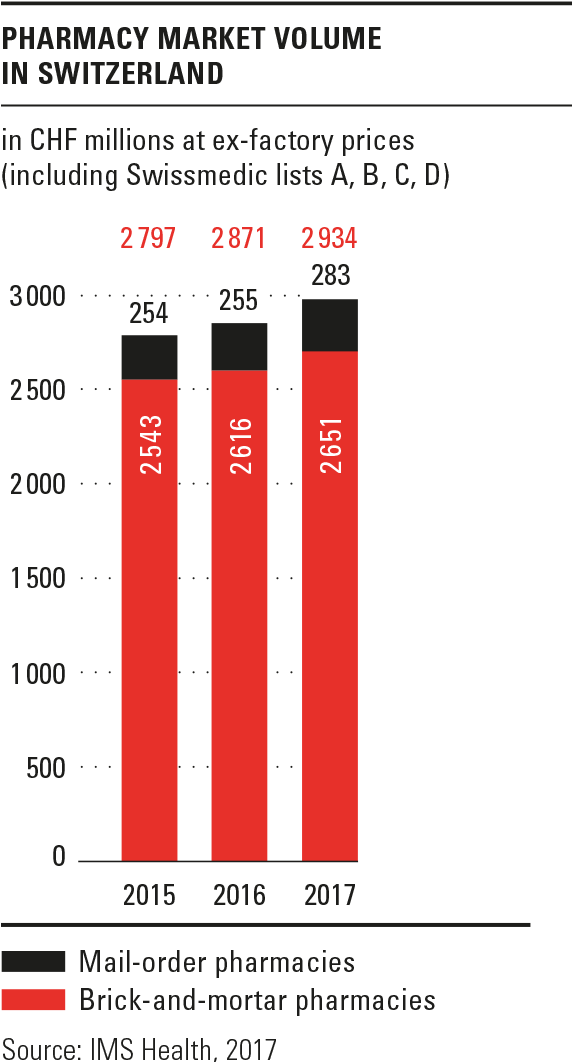

Mail-order sales channel grows — Pharmacies were the most important sales channel in the drugs market, with a market share of 50.4 percent. This rose by 2.2 percent in 2017 to CHF 2.9 billion. While sales by brick-and-mortar pharmacies increased by only 1.3 percent, mail-order sales gained 11.1 percent. This rise in mail-order sales is attributable to the dispensation of expensive special medications, accompanied by specialized pharmaceutical services (Specialty Care). The supply of drugs and the support of treatment outside of inpatient and outpatient hospital care and medical institutions are becoming more and more important.

A digital manifesto for Switzerland — In January 2017, Federal Councillor Johann Schneider-Ammann presented a digital manifesto for Switzerland, signed by 50 pioneering thinkers. This manifesto serves as a source of inspiration for society, business and politics. It calls to create the conditions that will enable the optimum digital transformation of Switzerland. With regard to the legal requirements, it stresses that, “Regulations which are hostile to digitization must be avoided – legislation must not stand in the way of innovation and new ideas”.

Experts’ proposals relating to cost containment in the healthcare sector — In October a group of experts proposed 38 measures to contain costs in the healthcare sector on behalf of the Federal Council. Some of them relate to the supply of drugs. The group of experts recommends that the purchase of drugs and some medical equipment from abroad should be enabled and, contrary to the currently applied principle of territoriality, should be reimbursed by the insurance companies (measures 17 and 32). Generics should also be dispensed wherever possible – both by self-dispensing doctors as well as by pharmacies (measure 24). Innovative insurance models should be encouraged – for example by means of a commitment to gatekeeping (measure 27). The health literacy of patients and the extent to which they are kept informed are to be improved in general (measure 5) and inefficiency resulting from inaccurate data recording is to be avoided (measure 6). Of these recommendations, two are currently under further development. Firstly, an experimentation element in the legislation is intended to ensure that innovative business models can be trialled without any obstructive regulatory hurdles (measure 2). Furthermore the Federal Council intends to present proposals to Parliament for the introduction of global budgets in the healthcare sector.

Revised Therapeutic Products Act — After the Revised Therapeutic Products Act (TPA) was passed by the legislator in 2016, the consultation on the corresponding ordinances was carried out in 2017. With the TPA revision and the proposed adjustments to the ordinances, the legislator is primarily pursuing the following objectives: to simplify market access for drugs by creating new approval options and to simplify self-medication, improve drugs safety and increase transparency in the supply of drugs. In the process of simplifying self-medication, dispensation category C of the Swissmedic list will be abolished. Most of the list C products will now be assigned to category D, so it will in future also be possible for drugstores to sell OTC products. Furthermore, the legislator is also enhancing the competence of the brick-and-mortar pharmacies, which will in future be allowed to dispense certain prescription drugs without a doctor’s prescription.

In spite of a clear declaration of their intention to modernize the Therapeutic Products Act, the politicians instead have cemented the arrangement by which a doctor’s prescription has first to be obtained for the mail-order sale of OTC products. Consequently, it is still not possible for Zur Rose to sell OTC products by mail-order on favorable terms, between 10 and 35 percent below the regular market price. The stipulation that the purchase of cheaper drugs from abroad is to be simplified is equally incomprehensible. The legislator could already have actively promoted the purchase of drugs through the mail-order channel with immediate savings of around 12 percent, as well as cost-efficient self-dispensation by doctors. In the course of the consultation Zur Rose expressed its views on various aspects of the ordinances.

Zur Rose business performance

In 2017 Zur Rose further pursued its business activities successfully. Active in the eCommerce business since 2001, the company is aware of its pioneering role in the field of digitization and – with a disruptive approach – continued to develop various services for the benefit of its customers. In conjunction with the pharmaceutical excellence of Zur Rose, this is the key to enhance customer loyalty.

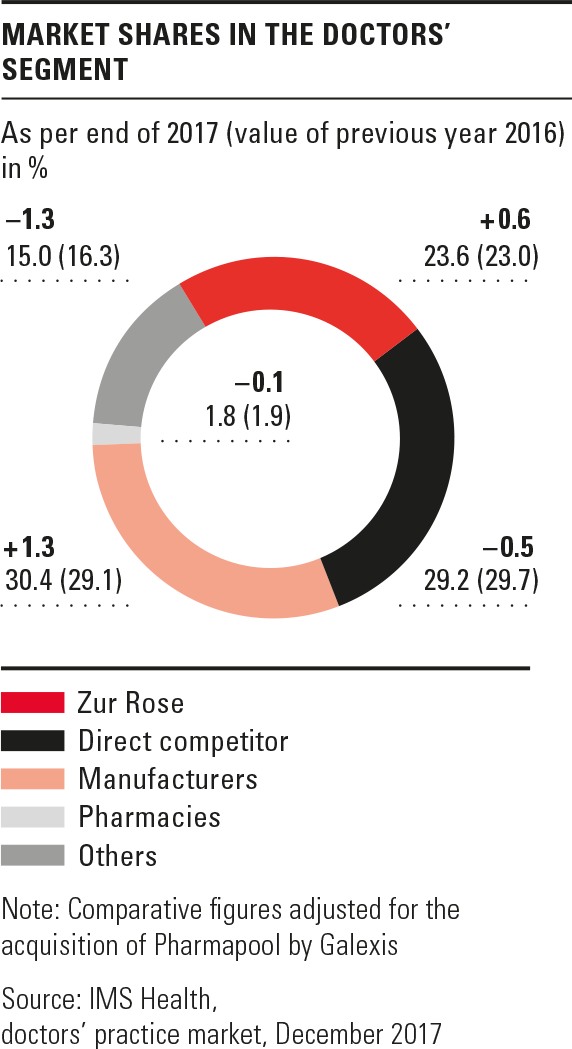

Gratifying growth in the doctor’s segment — Thanks to the gratifying acquisition of new customers, sales in the doctors’ segment (B2B) increased by 6.5 percent in 2017. Zur Rose has therefore further consolidated its position as one of the leading wholesale suppliers to medical doctors in Switzerland. In the meantime, market consolidation continued. For example, Pharmapool and the wholesale business of Spirig were taken over by Galexis.

The increasing digitization is also a driver of new developments in the management of drugs. In the reporting year, Zur Rose initiated various projects. Zur Rose made the “SmartOrder” tool available for online orders from doctors’ practices with direct drugs dispensation and it is already in use by over 500 doctors. SmartOrder enables real-time enquiries about original drugs and generic substitution and provides immediate availability information about the individual products. In addition, Zur Rose launched a digital delivery note archive in the reporting year, which will be rolled out in the market in the first quarter of 2018. This is based on the BlueConnect software of Zur Rose subsidiary BlueCare.

In 2017 the company held information events for doctors on relevant issues such as the revision of the TPA or the development of self-dispensation, which were attended by over 150 participants. Over 400 medical practice assistants and coordinators also attended the advanced education and training courses offered by Zur Rose on quality assurance of the doctor’s dispensary and patient communication.

Further development and enhancement of self-dispensation — In 2016, together with the Association of Doctors with a dispensary , Zur Rose launched the “SD-Rappen” (the self-dispensation centime). This joint financial contribution by doctors and Zur Rose on every pack of medication which was supplied generated CHF 110,000 in the first year, with the aid of which the first three funding projects were started. As a result of one of the projects, self-dispensing doctors’ practices now have the opportunity to access a database of package inserts in abbreviated, patient-friendly form and in various languages. This means that they can provide important information to patients who do not understand the language on the original package insert. In one of the other projects, a guideline was developed to provide self-dispensing doctors with assistance in dispensing drugs to patients in nursing homes. As of 1 January 2018, self-dispensation is now also approved in the municipalities of Neuhausen and Schaffhausen. So, Zur Rose has helped various Schaffhausen doctors with their preparation for the introduction of the scheme.

Innovative solutions for prescribing doctors — Services enjoying continuing popularity include the electronic patient report to increase therapy adherence and the prescription account for patients with multiple-use prescriptions and automatic renewal. Zur Rose has continued to expand its cooperation in this respect with doctors’ practices in regions where there is no dispensation by doctors.

Positive developments in the field of Specialty Care — Thanks to a more close-meshed sales network, new patients have been approached with regard to specialized support in the field of Specialty Care, and recruited for a service of that kind. By focussing closely on existing indication areas, efficient processes and high quality service were guaranteed. The streamlining of sales which were not profitable enough in the field of Specialty Care was completed in the reporting year.

Exclusive supply of drugs to Medbase Centres — In 2017 Zur Rose entered into a strategic cooperation arrangement with Medbase. The company, which is wholly owned by Migros, is Switzerland’s biggest service provider in the field of basic outpatient medical care. The Medbase Group currently looks after 450,000 patients in Switzerland, with a total of 1.8 million consultations per year. From now on, as a wholesale supplier to medical doctors, Zur Rose will be supplying all Medbase centres exclusively with drugs and will therefore be in a position to further expand its already high market share in the doctors’ segment. In the context of this cooperation, the two partners combine their respective medical and pharmaceutical expertise. In addition to developing integrated offerings, they have created a joint online platform, where they publish articles on medical, pharmaceutical and therapeutic themes. Health products will also be offered in coordination with these topics, which can be bought through the Zur Rose online shop, thus also opening up new growth opportunities for the mail-order business.

Updates in logistics — In 2017 Zur Rose continued to invest in its logistics infrastructure and optimized its warehouse management, workplaces and the delivery and refrigeration chain. With the commissioning of another shipping line with automatic document insertion, both capacity and service assurance have been increased by means of additional redundancy.

Strengthening the omni-channel strategy in the retail business — The retail business (B2C) grew again for the first time since the Federal Court ruling of 2015 to restrict OTC mail-order, with sales up by 2.2 percent year-on-year.

After initiating the implementation of its omni-channel strategy with the opening of the flagship pharmacy at the Welle7 in Bern in August 2016, Zur Rose continued to develop its market position in the retail business in 2017, opening Switzerland’s first shop-in-shop pharmacy in the Migros branch on Bern’s Marktgasse in July. Bearing the Zur Rose brand, this offers an innovative pharmacy concept on around 50 square metres of floor space. Customers can conveniently combine their shopping at Migros with the purchase of pharmaceutical products and at the same time even collect Cumulus points. The shop-in-shop pharmacy has an automated warehouse, a consultation room and large advice screens with a touchscreen function, which can be used to access detailed information about individual products.

Following the omni-channel strategy, products can be ordered in the shop-in-shop pharmacy, collected from the branch or delivered to the home if required – all at the same attractive terms and conditions as through the mail-order channel. Over 20 percent of sales transactions are already handled in the context of omni-channel processes. The new shop-in-shop-concept is very well received by the customers. For that reason, Migros and Zur Rose decided at the end of 2017 to open more shop-in-shop pharmacies in 2018: The Zur Rose shop-in-shop pharmacy in the Migros Claramarkt store in Basel will open up for business in the middle of the year. In the second half of the year this will be joined by another shop at Migros HQ at Limmatplatz in Zurich. Additional locations are being evaluated.

The development of the flagship pharmacy at the Welle7 right by the main railway station in Bern is also developing favourably, with steady growth in terms of both sales and customer numbers.

Further development of the eCommerce platform in Consumer Healthcare — The healthcare range has been further optimized in the online shop and more brands have been added. New measures have been tested and successfully introduced in the marketing for both new and existing customers. The proportion of those users who access the Zur Rose website and the online shop using mobile devices rose considerably in the reporting year.

With regard to the omni-channel strategy and a holistic view of customers, December saw the start of a complete update of the online presence of Zur Rose. A state-of-the-art modular online platform based on SAP Hybris is being created in responsive design. It takes into account the needs of the different customer groups and links the touchpoints of the customer journey.

Development of cooperation with the health insurance companies — Against the background of growing pressure on the part of the Federal Office of Public Health to do something to counter rising healthcare costs, various insurance companies are recommending to their customers that they should buy their drugs via the cost-effective mail-order channel. For that reason, Zur Rose further expanded its cooperation with the insurance companies (B2B2C) in the reporting year and strengthened the team of employees responsible for it. Mail-order is to be integrated increasingly as a cost-effective and high-quality channel into alternative insurance models, such as general practitioner and HMO models.

Just in time for the announcement of the new premium round in the autumn by Federal Councillor Alain Berset, who announced an average premium increase of 4 percent compared with the previous year, Zur Rose launched a new basic insurance model together with KPT. For a premium discount of up to 20%, the insured persons with this mandatory basic health insurance product undertake to contact a telemedicine consulting service before utilising any medical services and to obtain prescription drugs through Zur Rose. Generics will be prescribed unless medical reasons dictate otherwise.

Successful basic inspection by the therapeutic products control agency — The therapeutic products control agency (Heilmittelkontrolle) of Zurich conducted a basic inspection for the wholesale business of Zur Rose in June. The focus was on an examination of the approvals for the wholesale of drugs, as well as their import and export.

New digital social media platform — In order to be able to guarantee immediate access to important information for employees without a computer workstation, wherever and whenever they need it, and to encourage the internal transfer of knowledge, Zur Rose launched its own mobile app in November. This can be downloaded onto a smartphone but it can also be accessed via a desktop workstation. The app enables information to be forwarded inside the company easily and across hierarchies to the required group of recipients.

BlueCare business performance

For 20 years BlueCare has actively contributed to the digitization of the Swiss healthcare sector, working together with doctors’ practices, managed care organizations and hospitals to achieve cross-sector networking.

BlueConnect generates added value — BlueCare actively promoted various projects in 2017. The transfer management tool BlueConnect proved to be particularly successful and was already used by 434 doctors in the reporting year. BlueConnect not only improves the processes in doctor’s practices but also creates added value for the healthcare system as a whole. The Cantonal Hospital of Winterthur (KSW) also recognized this: Together with BlueCare, the KSW is implementing a project which is intended to network and empower its referring doctors and the healthcare region of Winterthur. One important and successful step in cooperation with partners took the form of the development of an interface between BlueConnect and the leading practice information system

Vitodata.

Exchange promotes ideas — Employees of BlueCare, Zur Rose and DocMorris have set up an Innovation Board to promote innovative ideas throughout the group, against the background of increasing digitization. Promising approaches are consolidated and developed further when there are prospects of success. The Innovation Board has demonstrated among other things that drug prescription checking with the aid of smart data can increase drug therapy safety. Based on these findings, projects are being actively promoted in the fields of data intelligence and smart data. Another project is intended to save Zur Rose’s doctor customers the trouble of storing mounds of paper, by making delivery notes available in the digital archive by means of BlueConnect. With the further development of managed care and the BlueEvidence information system, BlueCare is also focussing on the future and new options for integrated provision, including chronic care indicators and medication models.